April 15, 2024

This is a timeless lecture by Russell Napier. It is also applicable to the current economic and investing environment. Russell goes through twenty-one lessons from financial history. Download all the slides – link here.

- Spend as much time analyzing supply as you spend analyzing demand – the China impact.

- There is no relationship between GDP growth and the return from equities – price is what you pay and value is what you get.

- Pepper’s law – estimate how long the unsustainable can be sustained – double it and take off a month.

- ‘Never, ever think about anything else when you should be thinking about incentives’- Charlie Munger.

- Governments like markets only when they deliver the prices they want governments do suspend market prices.

- The ratio of corporate profits to GDP ratio must mean revert in a free society- one way to do this is inflation.

- In assessing the appropriateness of monetary policy assess both the price of money and the quantity of money – banks make money.

- The most dangerous form of speculation is the search for yield- ‘John Bull can stand many things but he cannot stand 2%’ Walter Bagehot.

- The real danger for investors from populism depends upon the strength of the constitution and the rule of law.

- The countries most likely to default on their debt are those that have defaulted on their debt- institutions count.

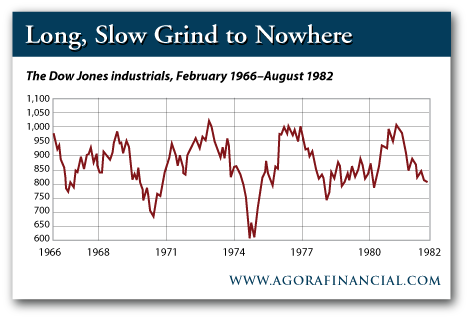

- High equity valuations fall slowly when the surprise is inflation and quickly when it is deflation – our current repression creates a slow decline.

- Never buy emerging market equities if the exchange rate is overvalued- an exchange rate policy is a monetary policy.

- Tourism is the best guide to whether an exchange rate is over-valued or under-valued always visit to Rockefeller Center at Christmas.

- Always buy equites below 10X CAPE unless the future holds – communism, war or a surrender of monetary independence with an overvalued exchange rate.

- Democracy is more suited to the operation of capital controls than the free movement of capital.

- When private savings are exhausted monetization of government debt and high inflation/hyperinflation follow – savings are not yet exhausted if conscripted.

- Technology never ultimately defeats inflation.

- Monetary systems fail about every 30 years – the rules of the old system leave a legacy of bad habits for those in a new system.

- Money is almost always in disequilibrium.

- Never trust a forecast with a decimal point-especially your own.

- Extrapolation is the opiate of the people.

- CedarOwl Commentary – Some interesting points and observations:

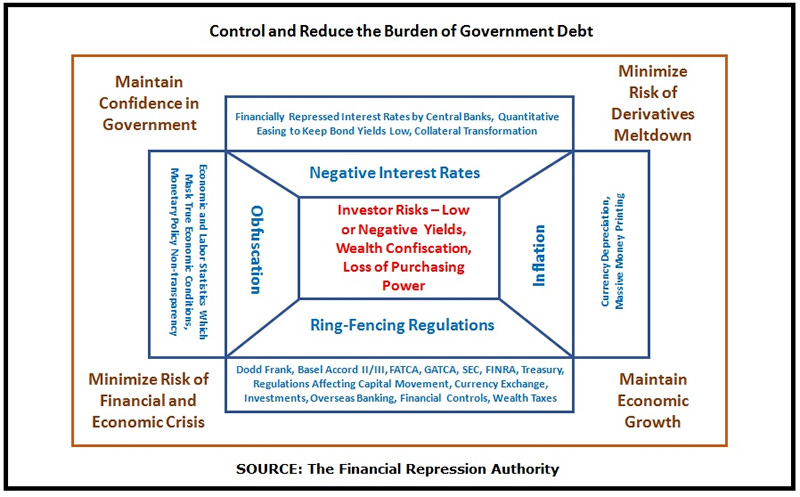

- Russell’s biggest theme is on the risks of financial repression – in many of the lessons he discusses in this presentation, he provides ideas to minimize these risks – jurisdictional-focused investing, diversification in asset classes, holding some gold and certain equities to preserve purchasing power, investing in jurisdictions where the rule of law and respect for property rights is strong and maintained, emphasizing equities versus bonds to minimize capital being forced to fund unsustainable reckless-spending governments.

- Thinks best to look for undervalued equities in emerging markets where currencies are not overvalued, instead of holding stagnant developed-world overvalued equities likely to go no where (or even losing purchasing power in real terms) in a manner similar to what happened to equities between 1966 to 1982.

- Sees a massive disequilibrium, a result of the monetary change in the world today – will likely result in liquidity going to emerging markets, driving emerging market currencies stronger in general. Advises to look for value-based equities in emerging markets instead of growth equities in the indebted western world.

- Observes on the variation of the famous Karl Marx quote of “Religion is the opiate of the people” that extrapolation is really the danger as the opiate of the people. Also known as recent bias. Just because the western world countries have led economic growth and enhancement in the standard of living over the past several decades since World War II – does not mean that this trend will go on forever. The western world countries are now heavily indebted, finding it increasingly difficult to even make the minimum payments on servicing their existing unsustainable government debt levels.

Become a free subscriber by entering your email address in the form below:

04/17/2024 - CedarOwl – Russell Napier. Twenty One Lessons from Financial History for the Way We Live Now.

04/17/2024 - CedarOwl – Russell Napier. Twenty One Lessons from Financial History for the Way We Live Now.