Our FRA video guest, Graham Summers of Phoenix Capital Research reports that it will be much, much harder to get your money out during the next crisis:

Consider the recent regulations implemented by SEC to stop withdrawals from happening should another crisis occur.

The regulation is called Rules Provide Structural and Operational Reform to Address Run Risks in Money Market Funds. It sounds relatively innocuous until you get to the below quote:

Redemption Gates – Under the rules, if a money market fund’s level of weekly liquid assets falls below 30 percent, a money market fund’s board could in its discretion temporarily suspend redemptions (gate). To impose a gate, the board of directors would find that imposing a gate is in the money market fund’s best interests. A money market fund that imposes a gate would be required to lift that gate within 10 business days, although the board of directors could determine to lift the gate earlier. Money market funds would not be able to impose a gate for more than 10 business days in any 90-day period…

Also see…

Government Money Market Funds – Government money market funds would not be subject to the new fees and gates provisions. However, under the proposed rules, these funds could voluntarily opt into them, if previously disclosed to investors.

http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370542347

In simple terms, if the system is ever under duress again, Money market funds can lock in capital (meaning you can’t get your money out) for up to 10 days. If the financial system was healthy and stable, there is no reason the regulators would be implementing this kind of reform.

As Zero Hedge noted earlier today, the use of “gates” is spreading. A hedge fund just suspended redemptions… meaning investors cannot get their money out. Expect more and more of this to hit in the coming months as anyone who is has bet the farm on the system continuing to expand gets taken to the cleaners.

The solution, as it was in 2008, will not be to allow the defaults/ debt restructuring to occur. Instead, it will be focused on forcing investors to stay fully invested at whatever cost.

This is just the start of a much larger strategy of declaring War on Cash.

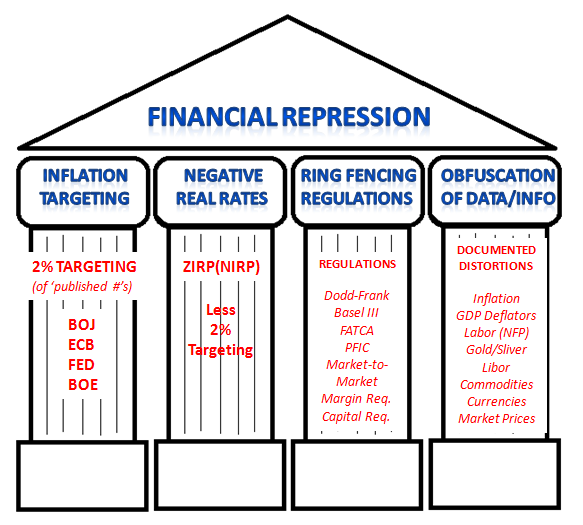

This is part of one of the pillars of Financial Repression that the FRA refers to as “Regulatory Ring Fencing”

12/12/2015 - REGULATORY RING FENCING: “Rules Provide Structural and Operational Reform to Address Run Risks in Money Market Funds”

12/12/2015 - REGULATORY RING FENCING: “Rules Provide Structural and Operational Reform to Address Run Risks in Money Market Funds”